top of page

Search

All Posts

Karnataka HC Dismisses Tax Assessment Cases U/S 148A(b) for Failure to Serve Show-Cause Notice

<p>The Karnataka High Court in a ruling has quashed the income tax assessment proceedings u/s 148A (b) of the Income Tax Act, 1961 as of the non-service of the show-cause notice. The applicant Sithappana Halli Bychappa Padmanabha Gowda contested the validity of distinct notices and orders issued via the income tax department specifically the notice […]</p>

knp gst

Sep 17, 20242 min read

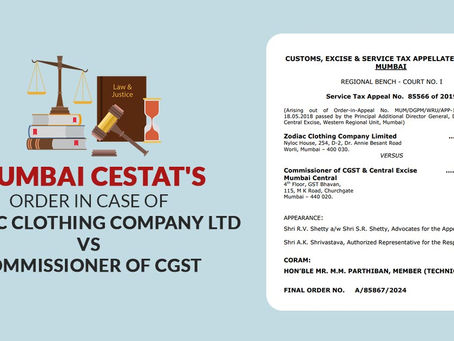

CESTAT: Goods Exported Before New Notification Were Not Subject to Conditions That Would Deny a Tax Refund

<p>It was cited by the Mumbai Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) that as the refund claim is for the exports which has been taken place prior to the new notification, the provision to provide the returns as cited in the new notification does not apply and could not get used […]</p>

knp gst

Sep 17, 20243 min read

Ahmedabad ITAT: Accumulation Income Can Be Used to Buy Fixed Assets Under Income Tax Section 11(6)

<p>The petition of the taxpayer ruling has been permitted by the Ahmedabad Bench of Income Tax Appellate Tribunal (ITAT) which collected income could be applied to the acquisition of the fixed assets u/s 11(6) of the Income Tax Act,1961. Gujarat Safety Council, the appellant-assessee, was a trust that led safety training programs. It filed a […]</p>

knp gst

Sep 16, 20242 min read

Karnataka HC: 7 Days Should Be Granted for Responding to an Income Tax Notice Issued U/S 148a(b)

<p>The applicant, Bangalore Thulaseedas Srinath contested several notices and orders issued to the applicant, including those u/s 148A(b), 148A(d), 148, 147 r/w 144 and 144B and pertinent penalty notices u/s 274 read with Sections 272A(1)(d), 270A and 271B. It was furnished by the applicant that the income tax notice issued u/s 148A(b) of the Act […]</p>

knp gst

Sep 16, 20242 min read

Are You Receiving a TDS Mismatch Notice? How to Resolve

<p>If you receive a TDS mismatch notice from the income tax department, SAG Infotech can guide you through the entire process of resolving this error legally. A technical professional from a reputed company was surprised to obtain a tax demand of approximately Rs 1.98 lakh concerned with his income tax return (ITR) filed for the […]</p>

knp gst

Sep 15, 20243 min read

No Clear Proof of Undisclosed Income: Delhi ITAT Cancels Tax Penalty U/S 271AAB

<p>The penalty has been removed by the New Delhi Bench of Income Tax Appellate Tribunal ( ITAT ) u/s 271AAB of the Income Tax Act, 1961 for alleged undisclosed income during the search. The decision was arrived at because of the clear evidence to prove the allegation. A search has been conducted by the revenue […]</p>

knp gst

Sep 14, 20242 min read

Bangalore ITAT Decides to Return the Matter to the AO After CTI(A) Sent a Notice to Wrong Email Address

<p>The Bangalore Bench of Income Tax Appellate Tribunal ( ITAT ) remitted the case to the Assessing Officer ( AO ) for reassessment discovering that the Commissioner of Income Tax (Appeals) had sent notices to an inaccurate email address. The appellant-assessee, Venkataraju Chandra Shekar, had filed an appeal contesting the order for the Assessment Year […]</p>

knp gst

Sep 13, 20242 min read

ITAT Removes INR 14 Lakhs Addition U/S 69A Due to Incorrect Transaction Details Recorded by AO

<p>U/s 69A of Income Tax Act,1961 the Bangalore Bench of Income Tax Appellate Tribunal ( ITAT ) deleted a Rs. 14 lakh addition made by the Assessing Officer (AO). The addition was based on wrong information concerning a property transaction, where the AO incorrectly recorded the purchase price as Rs. 45 lakhs instead of the […]</p>

knp gst

Sep 13, 20242 min read

Mumbai ITAT Rules Unsecured Loans as Unaccounted Money, Orders Addition U/S 68

<p>Discovering that the loans were nothing, however, the accommodation entries along with the repayment are indeed nothing only the return of accommodation entries, the Mumbai ITAT ruled that the money has been drawn in getting the unsecured loan is nothing but the unaccounted money of the taxpayer and is to be added under section 68. […]</p>

knp gst

Sep 12, 20242 min read

Delhi ITAT: No Need to Maintain Books of Account for An Agriculturalist U/S 44AA to Claim Tax Exemption U/S 10(1)

<p>The Delhi ITAT while granting exemption on agricultural income under section 10(1) ruled that the taxpayer being an agriculturalist would not need to maintain books of account as per Sec 44AA. Section 44AA of the Income Tax Act deals with the maintenance of books of accounts by specific persons maintaining on business or profession. Single […]</p>

knp gst

Sep 12, 20242 min read

Delhi HC: IT Assessment Can’t Be Re-opened Without Any Evidentiary Material U/S 148

<p>An income tax assessment cannot be reopened u/s 148 of the Income Tax Act without new material evidence and quashed the reassessment proceedings initiated for the Assessment Year 2015-16, Delhi HC held. The reassessment has been contended by the applicant on the basis that it was limited to time under the First Proviso to Section […]</p>

knp gst

Sep 11, 20242 min read

Leave Encashment Provisions Not Charged to the P&L A/c, Can’t Be Included in the Employer’s Income

<p>It was ruled by the Ahmedabad ITAT that the provision for leave encashment which was inherited by the taxpayer on the grounds of the restructuring practice of GEB, under which the majority of employers have been onboarded by the taxpayer company could not be added to the income of the taxpayer. The Division Bench of […]</p>

knp gst

Sep 11, 20242 min read

Bangalore ITAT Cancels Tax Penalty U/S 270 Due to Misunderstanding of Non-filing of ITR

<p>The Bangalore bench of the Income Tax Appellate Tribunal ( ITAT ) in a case quashed a tax penalty imposed u/s 270 of the Income Tax Act 1961, remarking that the taxpayer failed to file a Return due to a bona fide misunderstanding. The taxpayer Sekhon Jagtar Singh, in this case, is an individual who […]</p>

knp gst

Sep 11, 20243 min read

ITAT Allows Rectification Due to Misleading Suggestion by Auditor, Leading to Higher Tax Payment

<p>In a case, the Income Tax Appellate Tribunal (ITAT) of Bangalore ordered improvement of the amended return filed via the taxpayer, remarking that misadvice via the tax auditors of the taxpayer directed him to pay the excess income tax. The assessee Ramalingaiah, a semi-literate individual engaged in the business of tailoring and trading in textile […]</p>

knp gst

Sep 10, 20243 min read

Ahmedabad ITAT: Assessee Can’t Claim Deduction U/S 80P If ITR Filing is Done After Deadline U/S 139(1)

<p>It cited under the Ahmedabad Bench of the Income Tax Appellate Tribunal (ITAT) that the deduction under section 80P cannot be claimed in Income Tax Return (ITR) filing beyond the due date stipulated u/s 139(1) of the Income Tax Act. Dared Seva Sahkari Mandali Ltd. (Assessee) deposited cash of Rs. 5,31,61,730 and a time deposit […]</p>

knp gst

Sep 9, 20242 min read

Gujarat HC: Delayed Filing of 10-IC Form Won’t Affect Reduced Tax Rate if Conditions of Section 115BAA Are Met

<p>Witnessing that the taxpayer has fulfilled the conditions to lessen the tax rate under section 115BAA, the Gujarat High Court cited that the revenue department would required to condone delay in the filing of Form 10-IC instead of rejecting it on technical grounds. Section 115BAA of the Income Tax Act permits domestic companies to use […]</p>

knp gst

Sep 9, 20243 min read

Delhi ITAT Cancels Tax Penalty u/s 270 Due to Income Discrepancy Caused by Auditors’ Incorrect Recording of WDV in Audit

<p>The Delhi bench of the Income Tax Appellate Tribunal ( ITAT ) in a ruling removed the penalty u/s 270A of the Income Tax Act, 1961, quoting that the income difference was due to the wrong recording of the written down value (WDV) of the auditor in the tax audit report and noted that ‘to […]</p>

knp gst

Sep 7, 20243 min read

Former ICAI Chief: Taxpayers Can Challenge IT Notices Received U/S 148 for Assessments Reopening

<p>Under Section 148, Some taxpayers have imposed notices pertinent to the reopening of the assessments for the assessment years 2014-15, 2015-16, 2016-17, and 2017-18. A former president of the Institute of Chartered Accountants of India ((ICAI), the chartered accountants’ professional body, thinks that these tax notices were mistakenly sent as the limitation of 6 years […]</p>

knp gst

Sep 6, 20242 min read

Supreme Court Denies Retrospective Benefit for Jeevan Adhar Policy Deposits

<p>The Supreme Court in a case denied giving the retrospective operation to the amended Section 80DD of the Income Tax Act, 1961 (“IT Act”) which furnished an option to the subscriber the Jeevan Adhar Policy (“Policy”) upon reaching the age of 60 years to halt the deposit made under the policy and utilize of the […]</p>

knp gst

Sep 5, 20243 min read

MP HC Deletes Addition U/s 68, Finding Insufficient Grounds for Appeal U/s 260A

<p>Discovering that legal norms have been applied effectively via the Tribunal in valuing the proof and there has been no substantial question that emerges for consideration, the Madhya Pradesh High Court authorized the measure of the Tribunal in removing the additions made u/s 68. Under section 68 of the Income tax Act where any sum […]</p>

knp gst

Sep 4, 20242 min read

bottom of page