top of page

Search

All Posts

Delhi ITAT: TDS U/S 195 Can’t be Deducted on Payments Made to Overseas Firms for Services Rendered Abroad

<p>When the taxpayer’s company has used the company’s services outside India and payment has been made outside India, the taxpayer company shall not be obligated to deduct tax at source u/s 195, New Delhi ITAT ruled. Under Section 195 of the Income Tax Act, TDS should be deducted at the time of credit or payment […]</p>

knp gst

Jul 22, 20242 min read

Bombay HC: IT Section 148A(d) Order Cannot Be Passed Without a Valid Sanction Under Section 151

<p>If an order is passed under section 148A(d) of the Income Tax Act in the lack of an appropriate sanction as per the provisions of Section 151 of the Income Tax Act, the order and the resulting notice u/s 148 shall need to be declared illegal, the Bombay High court ruled. The bench of Justice […]</p>

knp gst

Jul 19, 20242 min read

ICAI Highlights Tax Payment Issues to CBDT on ITR Portal

<p>At present the income tax portal is undergoing issues related to payment which prevents the assessees, CAs, and tax filers from finishing their transactions. Filers are prompted with error messages when trying to make any payments. ICAI has addressed the problems of the CBDT. Representations have been sent by the ICAI before the finance ministry […]</p>

knp gst

Jul 19, 20243 min read

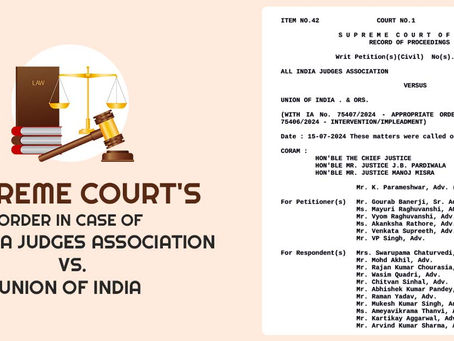

SC to Consider TDS Applicability on Allowances for Judicial Officers Under SNJPC, Next Hearing on 5th Aug

<p>The Supreme Court is ready to investigate the problem of the applicability of the provisions of tax deduction at source (TDS) on the allowances furnished before judicial officers under the Second National Judicial Pay Commission (SNJPC). The same issue has been analyzed via the Court in the All India Judges Association case in which it […]</p>

knp gst

Jul 18, 20243 min read

Karnataka HC Permits Writ Petition as Tax Refund Denied Without Hearing Opportunity

<p>The Income Tax refund was rejected without providing a chance to hear the Karnataka High Court ruled that. The Court held that the authority is required to consider the time available u/s 163(6) of the Income Tax Act,1961. The taxpayer Healthcare Global Enterprises Limited, contested the validity of the impugned Assessment Order computation sheet, and […]</p>

knp gst

Jul 17, 20242 min read

Bengaluru CA Taunts Narayana Murthy to Work on 70 Hours a Week Slogan

<p>A Bengaluru-based chartered accountant (CA) in between the rush to file the ITR before July 31 has a funny take on Infosys founder Narayana Murthy’s famous suggestion, encouraging young professionals to work 70 hours a week to build the country. While angering on X Basu (@Basappamv) mentioned that even after working for more than 70 […]</p>

knp gst

Jul 16, 20242 min read

Ahmedabad ITAT: IT Section 254(2) Only Allows Rectification of Mistakes, Not Recalling or Reviewing Orders

<p>The Ahmedabad Bench of Income Tax Appellate Tribunal ( ITAT ) has said that the provision of Section 254(2) of the Income Tax Act, 1961 could not be utilized for a recall and analysis order by the tribunal. It is believed that the aforesaid provision has the objective to rectify the mistake seen from the […]</p>

knp gst

Jul 15, 20242 min read

Kolkata ITAT: IT Sec 80G Benefits Are Not Denied Because Of A Technical Error During Approval

<p>The Kolkata ITAT Referring to the decision in the case of Anudip Foundation for Social Welfare vs. CIT(Exemption), Kolkata – ITA No. 1341/Kol/2023, ruled that the taxpayer will not be denied the advantage of the Sec 80G because of the technical errors emerged in making application as of the confusion and misunderstanding on in properly […]</p>

knp gst

Jul 15, 20242 min read

Kerala High Court: Non-filing Tax Returns After Assessment Order Can Be Fatal for Assessee

<p>The non-filing of the returns even after the receipt of the assessment order is fatal for the taxpayer, Kerala High Court ruled. It was noted by the bench of Justice A.K. Jayasankaran Nambiar and Justice Syam Kumar V.M. that the same might be correct that the respondents did not furnish a formal notice as needed […]</p>

knp gst

Jul 12, 20242 min read

Budget 2024-25: No Income Tax for Salaried Individuals If Exemption Limit Reaches ₹5 Lakh, See How

<p>In the Modi 3.0 regime, Finance Minister Nirmala Sitharaman will present her first budget on July 23 in Parliament. It will be her 7th straight budget presentation with an interim one presented in February this year. Taxpayers, particularly those in the middle class, are anticipating the Modi government’s tax relief measures with just a fortnight […]</p>

knp gst

Jul 11, 20243 min read

Karnataka HC Dismisses Criminal Proceedings Pertaining to Alleged Forged ITR with Fake CA Seal

<p>The Karnataka High Court in a judgment quashed the criminal proceedings alleging a fake ITR with a bogus Chartered Accountant (CA) seal, mentioning jurisdictional problems. The petition was being filed contesting the enrollment of a First Information Report which has culminated in the filing of a charge sheet. Taxpayer No.1 Vidya Sachitanand Suvarna was a […]</p>

knp gst

Jul 10, 20242 min read

Kerala HC Deletes a Tax Order as an IT Officer Didn’t Fulfill Their Responsibility

<p>If the income tax officer who hears the case does not render the decision, it would directed to a breach of the principles of natural justice, Kerala High Court ruled. The bench of Justice Murali Purushothaman has marked that the doctrine ‘he who heard should decide or he who decides should hear’ applies to legal […]</p>

knp gst

Jul 10, 20242 min read

IT Dept. Notifies New Guidelines for Making Transparent Process U/S 148

<p>The Central Board of Direct Taxes (CBDT) in a move to ease the process of issuing the notices u/s 148 of the Income Tax Act, 1961, has issued updated guidelines via F.No.299/10/2022-Dir(Inv.III)/1522 on June 26, 2024. Such guidelines are set to draw clarity and consistency in managing the matter concerned with the income that has […]</p>

knp gst

Jul 9, 20241 min read

Mumbai ITAT: No Reopening Assessment Can Be Done After 4 Years for Non-Filing of GST By Dealer

<p>It was ruled by The Mumbai Bench of Income Tax Appellate Tribunal (ITAT) that no reopening can take place after the expiry of four years from the end of the relevant assessment year unless any income levied to tax has escaped assessment for the reasons of the failure on the taxpayers part to reveal truly […]</p>

knp gst

Jul 9, 20242 min read

ITAT Raipur Removes Income Tax Reassessment for Unspecified Reasons

<p>The Raipur Bench of the Income Tax Appellate Tribunal (ITAT) sets aside income tax reassessment completed without furnishing a copy of the reasons. The Tribunal found that the Commissioner of Income Tax (Appeals)[ CIT(A) ] had not regarded the adjournment request of the taxpayer as neither additional submission nor legal grounds / additional grounds assailed […]</p>

knp gst

Jul 9, 20242 min read

Calcutta HC: Mobile Service Provider Cannot Be Obliged to Deduct TDS on Income Earned by Supplier

<p>It was ruled by the Calcutta High Court that cellular mobile service providers are not obliged to deduct the tax at source (TDS) on income received by distributors/franchisees from customers. The bench of Justice Surya Prakash Kesarwani and Justice Rajarshi Bharadwaj has relied on the Supreme Court’s decision in the case of Bharti Cellular Limited […]</p>

knp gst

Jul 8, 20242 min read

Bangalore ITAT: In the Absence of Technical Skills, Payment to AE Abroad Doesn’t Come Under ‘FTS’

<p>The Income Tax Appellate Tribunal (ITAT) of Bangalore in its judgment addressed the problem of whether the payments made via Herbalife International India Pvt. Ltd. to its associated enterprise (AE) abroad are authorized as “Fees for Technical Services” (FTS) under Indian tax laws and the India-USA Double Taxation Avoidance Agreement (DTAA). The case, Herbalife International […]</p>

knp gst

Jul 8, 20243 min read

ITAT Bangalore: No Tax Penalty U/S 271D for Cash Receipts If Reasonable Cause Exists

<p>In the matter of Laxmilal Badolla vs. NFAC (ITAT Bangalore), the issue is concerned with the levying of penalty u/s 271D of the Income Tax Act, 1961, concerning cash receipts in the course of the AY 2016-17. A Detailed summary of the judgment delivered by the ITAT Bangalore has been stated below- Backdrop: Laxmilal Badolla, […]</p>

knp gst

Jul 6, 20243 min read

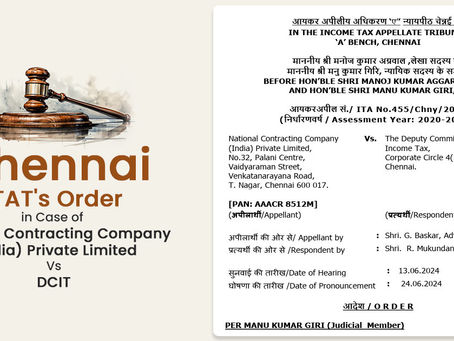

ITAT Chennai: Classification Errors Don’t Disqualify Deductions in ITR

<p>In the case of National Contracting Company (India) Private Limited vs. Deputy Commissioner of Income Tax (DCIT), the Chennai Income Tax Appellate Tribunal (ITAT) delivered a ruling. On June 24, 2024, the decision, pronounced, addresses the problem of whether a wrong classification in an Income Tax Return (ITR) can result in the refusal of a […]</p>

knp gst

Jul 5, 20242 min read

Rajasthan HC Upholds Use of IT Section 148A(d) for Inquiry into Suspected Tax Discrepancies

<p>The matter of Laxmi Meena Vs Union of India & Ors. before the Rajasthan High Court is concerned with the legality of proceedings initiated u/s 148A(d) of the Income Tax Act, 1961, established on facts proposing differences in reported income from a property transaction. Below is a detailed case summary: A Summary of the Arguments […]</p>

knp gst

Jul 3, 20243 min read

bottom of page