Easy File Online Form 10F for NRIs Who Don’t Have a PAN

- knp gst

- Oct 22, 2023

- 2 min read

The Central Board of Direct Taxes (CBDT) made a significant change in July 2022 by making it mandatory to electronically file Form 10F. Initially, non-residents without Permanent Account Number cards were given a relaxation, but this grace period has now ended. Starting from October 1, 2023, anyone seeking treaty benefits must electronically file Form 10F, regardless of whether they have a PAN card or not.

Fill Form for ITR & TDS Compliance Software

Guaranteed Offer for Tax Experts*

Δdocument.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() );

Easy Steps to File Online Form 10F for NRIs

To assist non-residents in navigating the electronic filing process for Form 10F, here is a step-by-step guide:

Step 1: Access the E-Filing Web Portal

Go to the e-filing web portal at https://eportal.incometax.gov.in/

To start the registration process, simply click on the “Register” button positioned at the upper right-hand corner of the webpage.

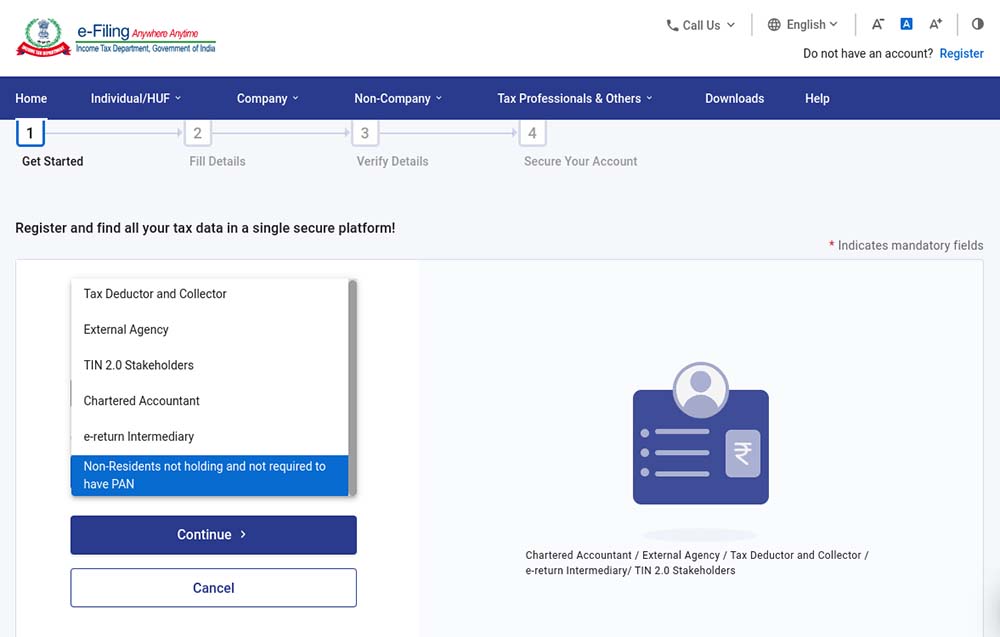

Step 2: Registration Category

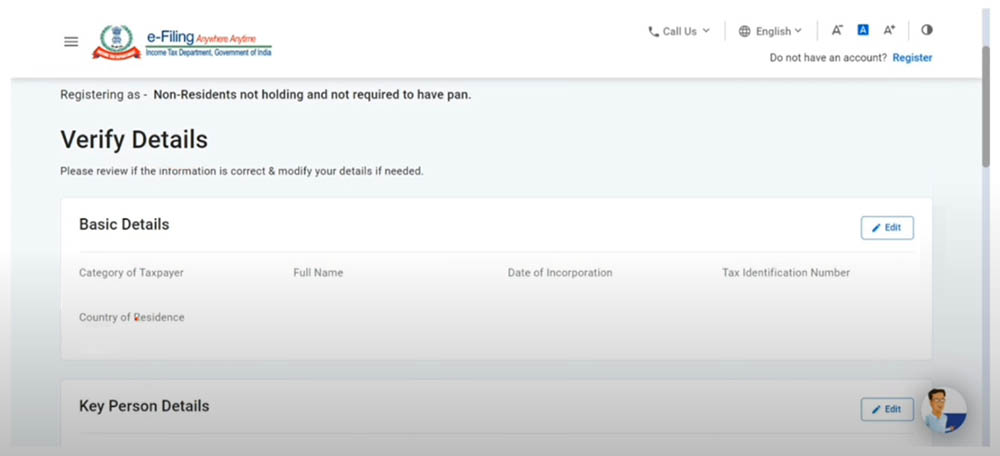

Choose the “Others” option and click on “Non-residents not holding and not required to have PAN” from the provided list of choices in the drop-down menu.

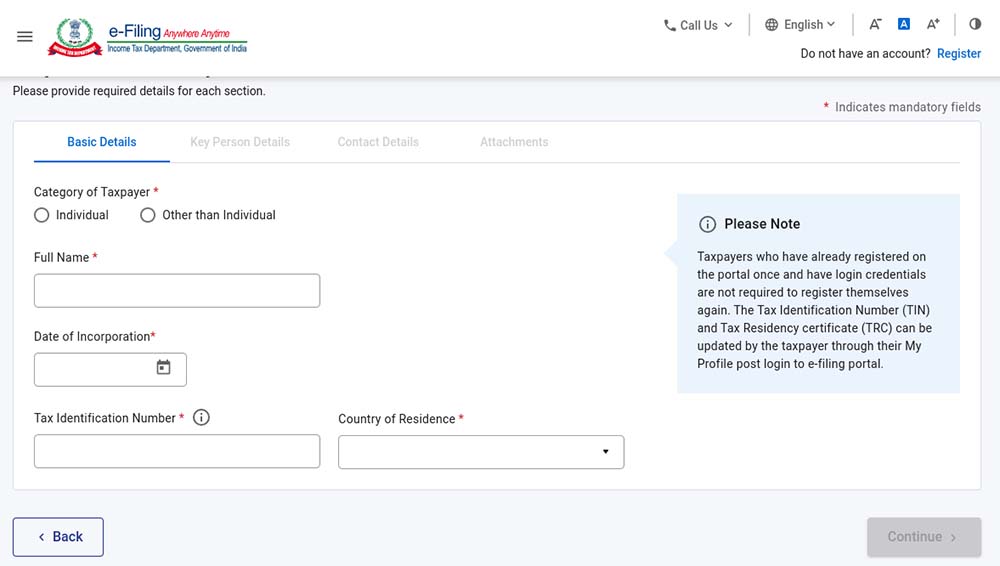

Step 3: Taxpayer Information

Fill in the necessary details, including your full name, date of incorporation/birth, tax identification number, and country of residence.

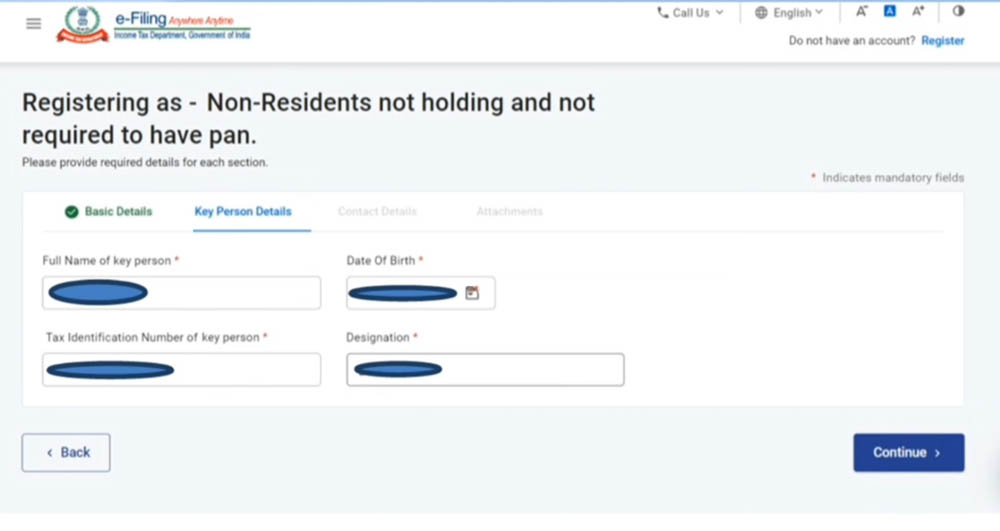

Step 4: Key Person Details

Furnish the relevant information concerning the key person, which includes their full name, date of birth, tax identification number, and designation.

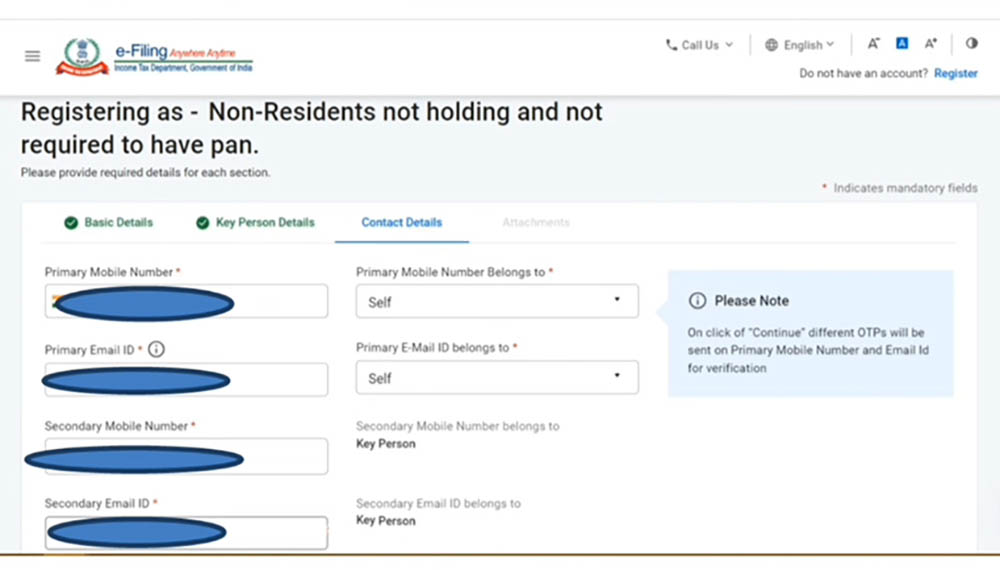

Step 5: Contact Information

Provide contact details for the key person and include a secondary email and contact details. Keep in mind that you will receive a one-time password (OTP) on your primary mobile number and email ID.

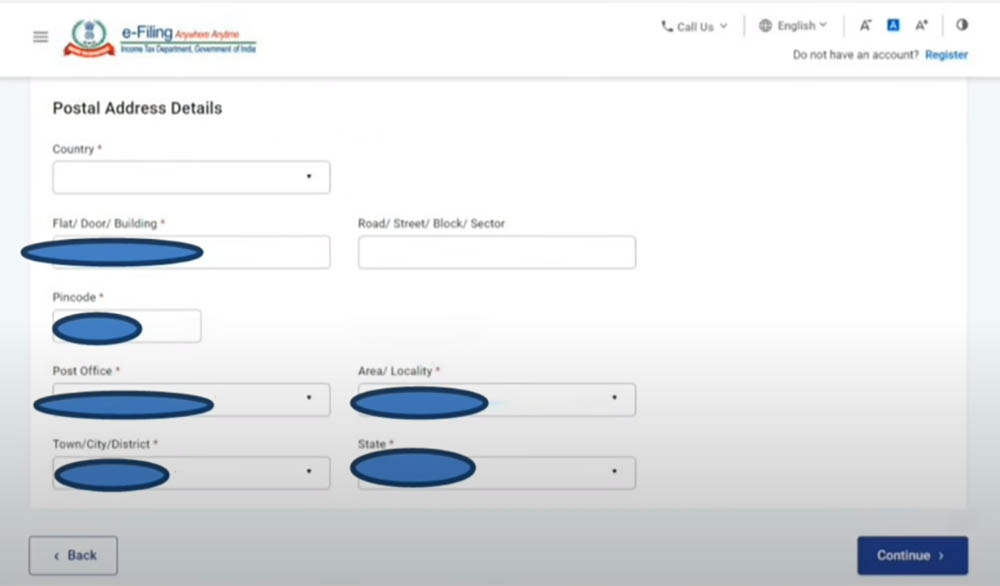

Step 6: Postal Address

Enter the company’s postal address.

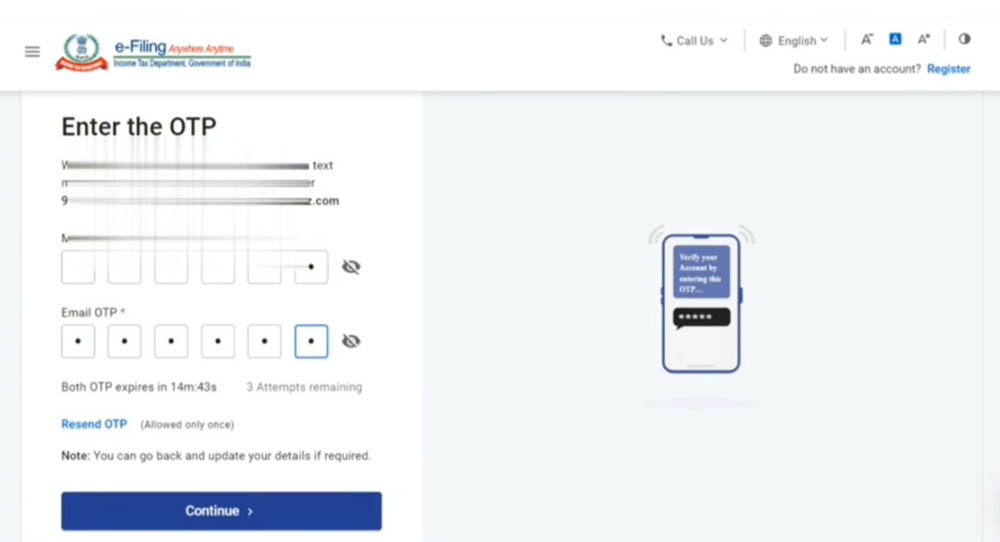

Step 7: OTP Confirmation

Enter the One-Time Password (OTP) that you have received on your main email address and primary mobile number.

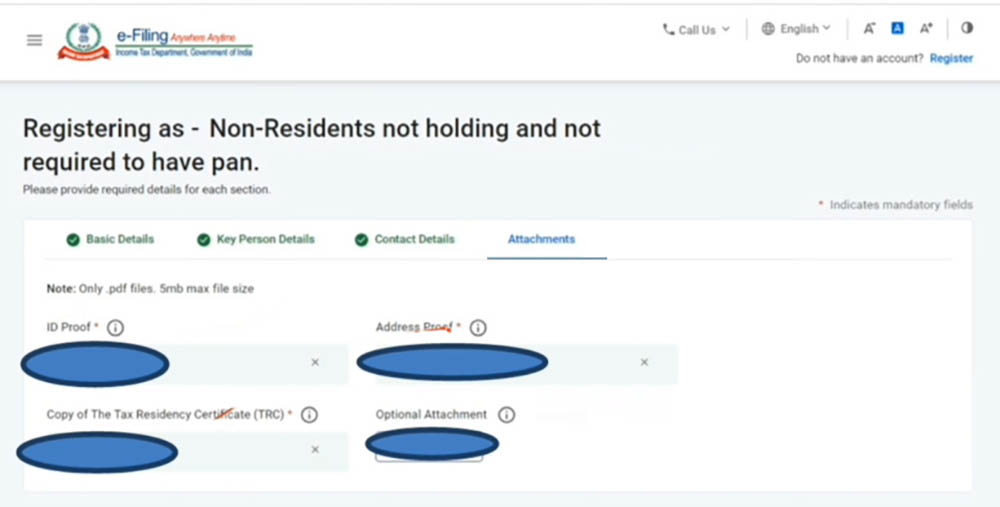

Step 8: Document Attachments

Attach the necessary documents, such as the Tax Residency Certificate, as required.

Step 9: Submission

Once you have completed all the previous steps, submit the Form.

By following the aforesaid instructions, non-residents can effectively submit their Form 10F on the Income Tax Portal. E-filing of Form 10F is crucial for availing of Tax Treaty benefits, and this guide provides a hassle-free process of fulfilment of all the necessary prerequisites.

Comments