top of page

Search

All Posts

FM Sitharaman Chairs Meeting for Comprehensive Review of the Income Tax Act, 1961

<p>A meeting on the comprehensive review of the Income Tax Act 1961 has been chaired by the Union Finance Minister Nirmala Sitharaman. Revenue Secretary Sanjay Malhotra, Central Board of Direct Taxes (CBDT) Chairman Ravi Agarwal, and other senior CBDT officials also attended the meeting. A comprehensive review of the Income Tax Act 1961 in the […]</p>

knp gst

Nov 5, 20242 min read

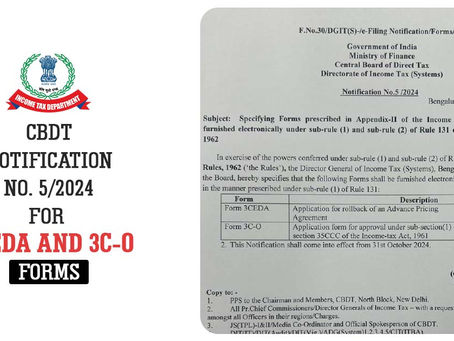

CBDT Allows Electronic Filing of Forms 3CEDA and 3C-O Via Notification No. 5/2024

<p>The Central Board of Direct Taxes (CBDT) in an update for the taxpayers via the Directorate of Income Tax (Systems), has issued Notification No. 5/2024 dated October 30, 2024, obligating the submission of certain forms electronically which is listed in Appendix-II of the Income Tax Rules, 1962. The same directive applies to the needed forms […]</p>

knp gst

Nov 4, 20241 min read

Kerala HC Rejects Tax Reassessment Order After Assessee Was Given Only 3 Days to Respond to SCN

<p>An order was set aside by the Kerala High Court in reassessment proceedings that were furnished without furnishing the taxpayer a chance to answer to the show cause notice. The Bench of Justice Gopinath P. marked that “the show cause notice was issued on 12-03-2024, giving only three days’ time to the assessee to respond, […]</p>

knp gst

Nov 1, 20242 min read

ITAT: Working Beyond Banking Hours Is a Likely Violation of Rules, But There Is No Basis for Assuming Additional Income

<p>The Delhi ITAT has removed the AO addition in the absence of any related proof, which was only based on the assumption and not on any material recovered in the investigation. ITAT mentioned that the taxpayer/employee undertaking overtime after the finish of working hours may be counted as a breach of banking rules, however, it […]</p>

knp gst

Oct 30, 20242 min read

Maharashtra and Karnataka Secure 1st and 2nd Positions in Direct Tax Collections

<p>Karnataka and Tamil Nadu in the South are counted under the top 5 states in India that account for 70% of India’s total direct tax collections. Maharashtra tops the list with 38.9%, accounting for a significant portion of tax collections, whereas Karnataka and Tamil Nadu rank second and fourth, respectively. Following Gujarat, Delhi has arrived […]</p>

knp gst

Oct 28, 20242 min read

Mumbai ITAT Cancels Assessment Order Until Higher Income Tax Authority Approves It Under Section 151

<p>The income tax assessment order has been quashed by the Mumbai Bench of Income Tax Appellate Tribunal (ITAT) as of the absence of higher authority approval u/s 151 of the Income Tax Act, 1961 for the reopening beyond three years. The taxpayer Sunil Harischandra Keni, filed a return claiming an income of Rs. 16,42,210 for […]</p>

knp gst

Oct 27, 20242 min read

ITAT Jaipur: IT Section 68 Provisions Do Not Apply to Sale Transactions Already Credited in the P&L

<p>It was ruled by ITAT Jaipur that provisions of 68 or such are not been applied on the transaction sale recorded in the books of accounts as the sale transactions are part of the income which is credited in the statement of profit & loss account. Case Facts AO in the assessment proceedings noted that […]</p>

knp gst

Oct 25, 20242 min read

J&K HC: Tax Penalty Notices Under IT Section 271(1)(c) Must Specify Reasons

<p>The Jammu and Kashmir and Ladakh High Court in a case has cited that the notice to a taxpayer offering the levying of the penalty u/s 271(1)(c) of the Income Tax Act, 1961 should cite the reason for levying the penalty. It was carried that it is required to be quoted whether the taxpayer is […]</p>

knp gst

Oct 25, 20242 min read

ITAT Upholds Income Tax Section 80P, Affirming Its Role in Promoting Co-Operative Societies

<p>It was carried that the Income Tax Appellate Tribunal (ITAT) carried the provisions of section 80P of the Income Tax Act, confirming its role in boosting the growth of cooperative societies. The ruling was created in the appeal related to the AY 2015-16 in which the Principal Commissioner of Income Tax (PCIT) had modified an […]</p>

knp gst

Oct 23, 20242 min read

Delhi HC: TDS Deducted by Employer U/S 245 Cannot Be Adjusted Against the Assessee’s Future Tax Refund

<p>A relief has been granted by the Delhi High Court before Satwant Singh Sanghera, a pilot formerly employed with the now-collapsed Kingfisher Airlines, against a tax demand of over Rs 11 lakh. It was claimed by Singh that he had duly furnished his ITR for the said assessment years and the company had deducted TDS […]</p>

knp gst

Oct 23, 20242 min read

CBDT Time Series Database Shows Income Tax Return Filers Exceed 10 Crore

<p>The number of income taxpayers in India surpasses 10 crore, showing an influential expansion in the tax base as per the updated time series data from the Central Board of Direct Taxes (CBDT). It exhibits a 98% rise over the past 10 years with the number of taxpayers rising from 5.26 crore at the finish […]</p>

knp gst

Oct 21, 20242 min read

New Income Tax Returns e-Filing Portal 3.0 Will Be Available for Practice Soon

<p>For income tax, the online e-filing ITR portal will be processed with a revamp via substantial amendments effective for taxpayers. The tax department’s internal circular which is not publicized dated October 8, 2024, expressed, “The operations phase of the existing Integrated e-filing and Centralised Processing Centre (IEC) 2.0 is coming to an end and the […]</p>

knp gst

Oct 21, 20243 min read

CBDT Releases Judicial Matters Handbook for Departmental Use Only

<p>A detailed guide for tax professionals and departmental officers is been proposed by the recently updated Handbook on Judicial Matters, prepared by the Office of the Principal Commissioner of Income Tax (Judicial). The book specifies the process to file the appeals in distinct judicial fora, including the Income Tax Appellate Tribunal (ITAT), High Court, and […]</p>

knp gst

Oct 21, 20242 min read

CBDT Rolls Out New Guidelines to Simplify Compounding of Income Tax Offences

<p>Central Board of Direct Taxes (CBDT) has provided the updated norms for the compounding of offences under the Income-tax Act, 1961, to facilitate the process as well as accessible for the assessees as per the statement from the Ministry of Finance. The guidelines are in the budget announcement list of the Finance Minister to streamline […]</p>

knp gst

Oct 21, 20242 min read

India’s Personal Income Tax Collection Increases by 294% Over the Past Decade

<p>An astonishing growth has been witnessed in the personal income tax collection in India over the past decade, exceeding the speed of corporate tax collections, as per the updated data released by the Central Board of Direct Taxes (CBDT). Personal income tax revenue surged by 294.3 per cent, increasing to Rs 10.45 lakh crore in […]</p>

knp gst

Oct 19, 20242 min read

Understanding New Tax Form 12BAA: Structure & Benefits

<p>The Central Board of Direct Taxes (CBDT) has introduced a new tax form called 12BAA, particularly made for the disclosure of non-salary income and inclusion of information on Tax Collected at Source (TCS). As per the guidelines, these forms with the norms emphasized in the Union Budget 2024 will streamline the offsetting of Tax Deducted […]</p>

knp gst

Oct 18, 20243 min read

CBDT Amends Rules for Forms 10A and 10AB under Sections 12A and 80G

<p>Amendments have been announced for Income-tax Rules through Notification No. 111/2024, dated October 15, 2024, by the Central Board of Direct Taxes (CBDT). These amendments effective from 1st October 2024 have the motive to facilitate the registration process for charitable institutions, trusts, and non-profit organizations under sections 12A and 80G of the Income-tax Act. Introduced […]</p>

knp gst

Oct 17, 20242 min read

Gujarat HC: IT Section 68 Does Not Apply if There is No Clear Declaration of Amount in the Bank Statement

<p>It was mentioned by the Gujarat High Court that there cannot be any income escapement from the taxpayer if there is no unexplained amount in the bank statement on record. The Bench of Justice Bhargav D. Karia and Mauna M. Bhatt noted that “the reason given by the Assessing Officer for alleged escapement of Rs.3,25,00,000/- […]</p>

knp gst

Oct 17, 20242 min read

Pune ITAT: Tax Deduction Can Be Claimed u/s 80IA If the Entity Operates, Develops, and Maintains Infra

<p>Directing to the decision of CIT vs. ABG Heavy Industries Ltd. (2010) 322 ITR 323, the Pune ITAT repeated that an enterprise can claim deduction under section 80IA if it develops, operates, and maintains the infrastructure facility, subject to the beginning of operation & maintenance of the infrastructure facility after April 01, 1995. The Bench […]</p>

knp gst

Oct 15, 20243 min read

Income Tax Department Sets Sights on High-Risk Refund Claims

<p>There shall be a systematic verification of high-risk refund claims in income tax returns for the AY 2024-25 (financial year ending March 31, 2024), following a standard operating procedure (SOP). the purpose is to find out if the wrong refund claim has been incurred in an organized way or via a single person. As per […]</p>

knp gst

Oct 14, 20242 min read

bottom of page